strategy and psychology of auction estimates

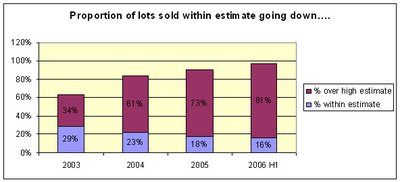

Auction estimates are just what they imply – a price range within which the artworks are estimated to sell. This range is usually determined by specialists at the auction house in concert with the consignors and serves as a price indicator to potential buyers. However, if we take a look at auction sales for Indian art since 2003 we see a steady increase in works selling over the pre auction high estimate. As a matter of fact, since 2003 the number has more than doubled to over 80% of all lots selling above the estimate. This is because putting an estimate on a work of art is far from an exact science and is dependent on a number of interlacing factors such as timing and market conditions, reserve price as well as an overall auction strategy.

Timing and market condition: The estimates are set as much as 10-14 weeks in advance of the sale date to accommodate for catalogue printing and distribution and are therefore based on prevailing market conditions several months before the sale. In a buoyant market this could mean a 15-25% variance even in such a short duration

Timing and market condition: The estimates are set as much as 10-14 weeks in advance of the sale date to accommodate for catalogue printing and distribution and are therefore based on prevailing market conditions several months before the sale. In a buoyant market this could mean a 15-25% variance even in such a short duration

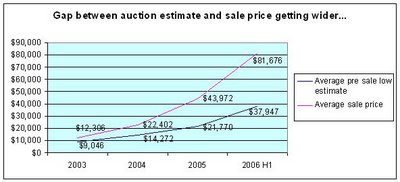

Reserve Price: As a rule, the reserve price (the price below which the seller is not willing to sell) is always below or at par with the low estimate. In a heated market where quality supply is in scarcity, consignors are able to demand a higher reserve in an effort to alleviate some of the risk of the work selling at sub optimal price levels. Combined data on Indian art from all the auction houses reveal that the average selling price in 2003 was about 35% over the average low presale estimate rising to a staggering 115% over the average low estimate in 2006

Combined data on Indian art from all the auction houses reveal that the average selling price in 2003 was about 35% over the average low presale estimate rising to a staggering 115% over the average low estimate in 2006

Bid Psychology: Auctions estimates are also guided by an overall strategy on the part of the sellers - a low estimate tempts more bidders looking for bargains to actively participate in the sale. This increases the competition, the excitement and desirability for the lot often pushing the price to a higher level then if the same lot had fewer bidders. A low bid strategy works best in a scenario where the buyers are broad-based and sufficiently knowledgeable to make decisions based on quality, provenance, rarity, condition etc.

Based on the above we can conclude that at best, published auction estimates are imperfect indicators of fair market value especially in a buoyant market and they cannot be used in isolation to make bid/buy decisions. However, moving forward we are likely to see works selling much closer to their estimate especially as the market becomes more efficient and mature.

<< Home